Calculating industrious repentance

Free program that carries out the calculations required to join the voluntary reform - It is sufficient to enter only four data and that's it - Finally, the F24 form statement appears to be used to make the payment

Itieffe is pleased to present you a powerful tool that will help you calculate your voluntary repentance quickly and accurately. Our program is designed to simplify and automate the process of determining penalties and interest due in the event of late payment of taxes or social security contributions. Industrious repentance is a complex and important topic in the context of tax and social security compliance, and it is essential to calculate it correctly to avoid penalties and comply with current laws.

Main features:

- Data entry: The program allows you to enter all the relevant data, including the amount owed, the original due date and the actual payment date.

- Automatic calculation: once the data has been entered, the program will automatically perform the necessary calculations to determine the amount of the voluntary compensation. There is no need to manually perform complex mathematical formulas.

- Clear display of results: The results are displayed in a clear and detailed way, allowing you to easily understand how the voluntary repentance was calculated.

- Print or export reports: You can print or export the reports generated by the program to keep them as documentation or share them with tax professionals or social security institutions, if necessary.

- Law and fee updates: The program will be constantly updated to reflect changes in tax and social security laws, ensuring that calculations always comply with the latest regulations.

Using the program:

- Data entry: start the program and enter the data relating to the tax or contribution on which you wish to calculate the voluntary repentance.

- Automatic calculation: the program will automatically perform the calculations, considering the specific rates and deadlines in force at the time of the calculation.

- Viewing results: the results will be shown clearly, indicating the amount of the voluntary repentance and any other relevant information.

- Print or export: If necessary, you can print or export the report for archival purposes or communication with tax authorities.

Important Note:

This program was developed with the goal of simplifying and improving the process of calculating tax compliance, but it is essential to consult a tax professional or legal advisor to ensure full compliance with local laws and regulations. The program is a support resource, but is not a substitute for professional advice.

The correct determination of voluntary repentance is crucial for prudent and compliant financial management. We hope that this tool will be of great help to you in managing your tax and social security matters.

Calculating industrious repentance

Have you ever failed to pay taxes on time?

The question that arises is: "And now what do I do"?

Desperately we open the Revenue Agency website to find a solution and that's when the brain goes haywire.

If you pay with x delay, you must increase the penalty by a certain amount, if you pay with a y delay, the penalty varies by two totals, however if you make use of the industrious repentance, then you must pay either 1/3 or 1/10 or 1 /9 etc. (and they are still not satisfied).

It's not enough to be sanctioned sometimes just for a trivial oversight, they must also abuse you psychologically. But wouldn't it be enough to create a little program with which the user, by inserting the few data that are needed (there are four), can easily find what is due to pay? He inserts it in the F24 Model and the game is done.

On the website of the Revenue Agency there is an application program for calculating penalties and interest but it is not easy to use.

We at Itieffe offer a very simple program that can be used by anyone, where by entering four data, we find the pre-compiled prospectus of the F24 model to be used to regularize everything.

Obviously, the information provided in this section is intended to be indicative and everyone is required to check the accuracy of the calculations.

Calculating industrious repentance

The active repentance was introduced by art. 13 of Legislative Decree 472/97 and allows the taxpayer to spontaneously regularize the non-payment (or insufficient) of taxes before he has been formally notified by the administration of any inspection, verification or assessment procedures against him.

As regards the taxes managed directly by the Revenue Agency, such as for example income taxes, the amendments introduced by Legislative Decree 158/2015 (new paragraph 1-ter of the aforementioned article 13) provide that the voluntary repentance is possible even if a tax inspection has already begun provided that no deed of liquidation or assessment has been notified (including communications from automated and formal control of returns).

Regularization takes place through the payment of the tax due, plus legal interest, and a reduced fine, the lower the amount the sooner the repentance occurs.

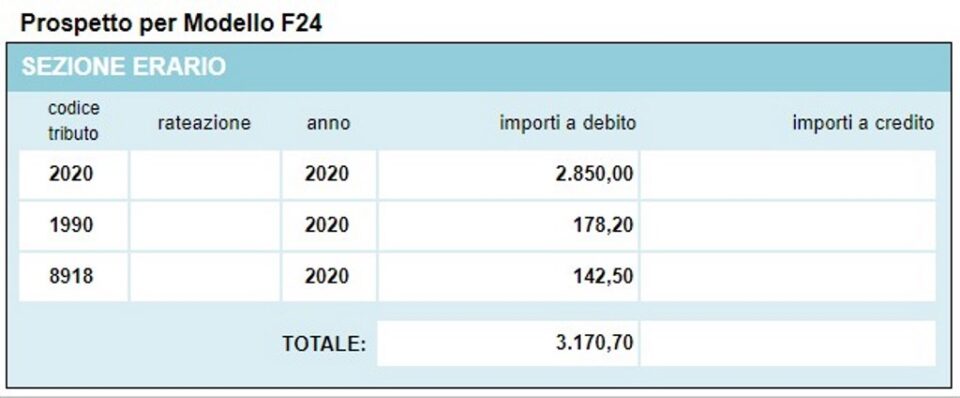

The payment of the reduced fine must be made at the same time as the regularization of the tax and the payment of interest; in other words, the payment of the three sums (tax, fine and interest) takes place through a single F24 form in which the three items must be kept separate, each with its own tax code.

However, it should be noted that, as established by paragraph 1-quater of art. 13, recourse to active repentance does not in any case prevent the Administration from undertaking subsequent verification and assessment actions against the tax payer.

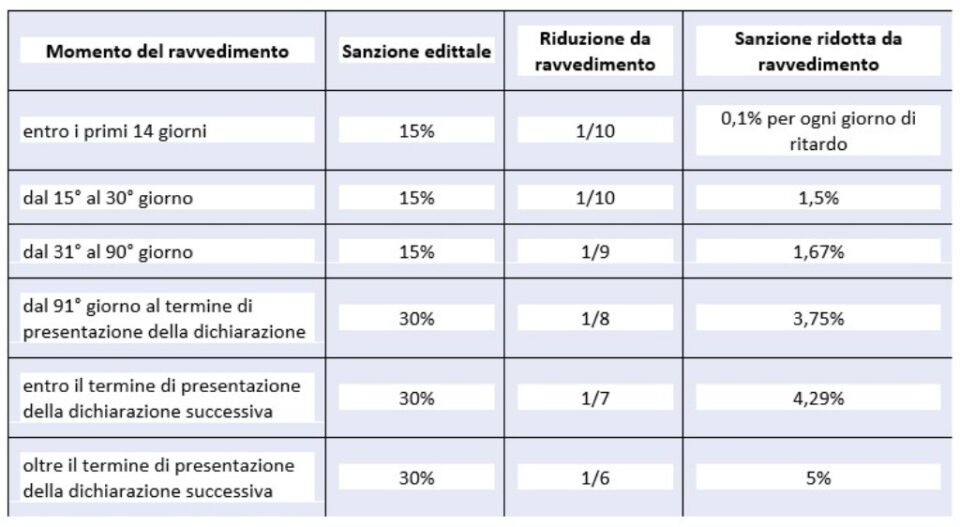

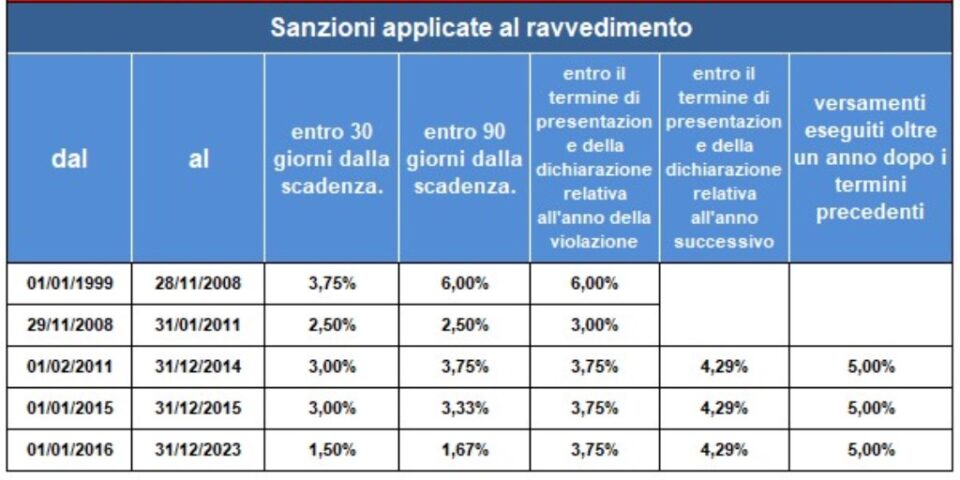

In particular, the ordinarily applicable statutory sanctions and those reduced following any active repentance can be summarized as indicated in the following table:

Calculating industrious repentance

Types of repentance for time limits

- sprint repentance: exercisable within the 14th day from the natural expiry of the payment, with the application of a penalty equal to 0,1% per day and therefore up to a maximum of 1,4% and interest at the legal rate which from ' 01/01/2022 is equal to 1,25% (for example, if the delay is 8 days, a fine of 0,80% will be applied (0,10% x 8 days = 0,80%), from fifteenth day up to the thirtieth day, instead the 1,50% penalty will be applied (short correction).

- brief repentance: for payments made after the 14th day but before the 30th; in this case the fine is equal to 1,5% (1/10 of 15%), in addition to interest at the legal rate which from 01/01/2022 is equal to 1,25%;

- intermediate repentance: for payments made after the 30th day but within the 90th day; the applicable fine is equal to 1,67% (1/9 of 15%), in addition to interest at the legal rate which from 01/01/2022 is equal to 1,25%;

- long repentance (within one year): for payments made within 1 year or, if envisaged, the declaration within the deadline for submitting the declaration relating to the year in which the violation was committed; the applicable fine is equal to 3,75 (1/8 of the minimum which is 90% beyond 30 days), plus interest at the legal rate which from 01/01/2022 is equal to 1,25%;

- biennial repentance: for payments made within the deadline for submitting the return relating to the following year or if the return is not envisaged, two years from the omission; the applicable fine is equal to 4,29 (1/7 of the minimum), plus interest at the legal rate which from 01/01/2022 is equal to 1,25%;

- very long or over two-year repentance: for payments made over a year; the applicable fine is equal to 5,00% (1/6 of the minimum), plus interest at the legal rate which from 01/01/2022 is equal to 1,25%.

Synoptic table of violations |

|||

| Violation of art. 13 paragraph 1 of Legislative Decree n. 472 of 1997 | sanction | Time limits | Type of tax |

| Sprint repentance | 0,1% for each day (in such cases the 15% fine is further reduced to 1/15 for each day of delay (1%) | Within 14 days of the deadline | Omitted and late payments of taxes and withholdings |

| Brief repentance | 1/10 of the minimum (1,5%) | Within 30 days from the date of the violation | Failure to pay all taxes |

| Revision within 90 days | 1/9 of the minimum (1,67%) | Within the 90th day following the deadline for submitting the return, or, when the periodic return is not envisaged, within 90 days of the omission | Errors and omissions in general, formal and substantial, including omitted payments. All tributes |

| Quarterly review | 1/9 of the minimum (1,67%) | For the payment of installments omitted after the first in cases of assessment with acceptance, agreement, conciliation, amicable notices. The possibility remains to use the sprint or short correction if the regularization takes place in a shorter time | All tributes |

| Long repentance | 1/8 of the minimum (3,75%) | Within the deadline for submitting the declaration relating to the year during which the violation was committed or, when no periodic declaration is required, within one year of the omission or error | Errors and omissions in general, formal and substantial, including omitted payments. All tributes. |

| Biennial review | 1/7 of the minimum (4,29%) | Within the deadline for submitting the return relating to the year following the one in which the violation was committed or, when no periodic return is required, within two years of the omission or error | Errors and omissions in general, formal and substantial, including omitted payments. All taxes administered by the Revenue Agency |

| Ultra-annual correction | 1/6 of the minimum (5%) | Beyond the deadline for submitting the return relating to the year following the one in which the violation was committed or, when no periodic return is required, beyond two years from the omission or error | Errors and omissions in general, formal and substantial, including omitted payments. All taxes administered by the Revenue Agency. |

| Correction subsequent to PVC (verbal of findings) | 1/5 of the minimum (6%) | If the regularization takes place after the violation of the PVC has been ascertained, excluding the cases of failure to issue a tax receipt, transport document, receipts or failure to install tax meters | Errors and omissions in general, formal and substantial, including omitted payments. All taxes administered by the Revenue Agency. |

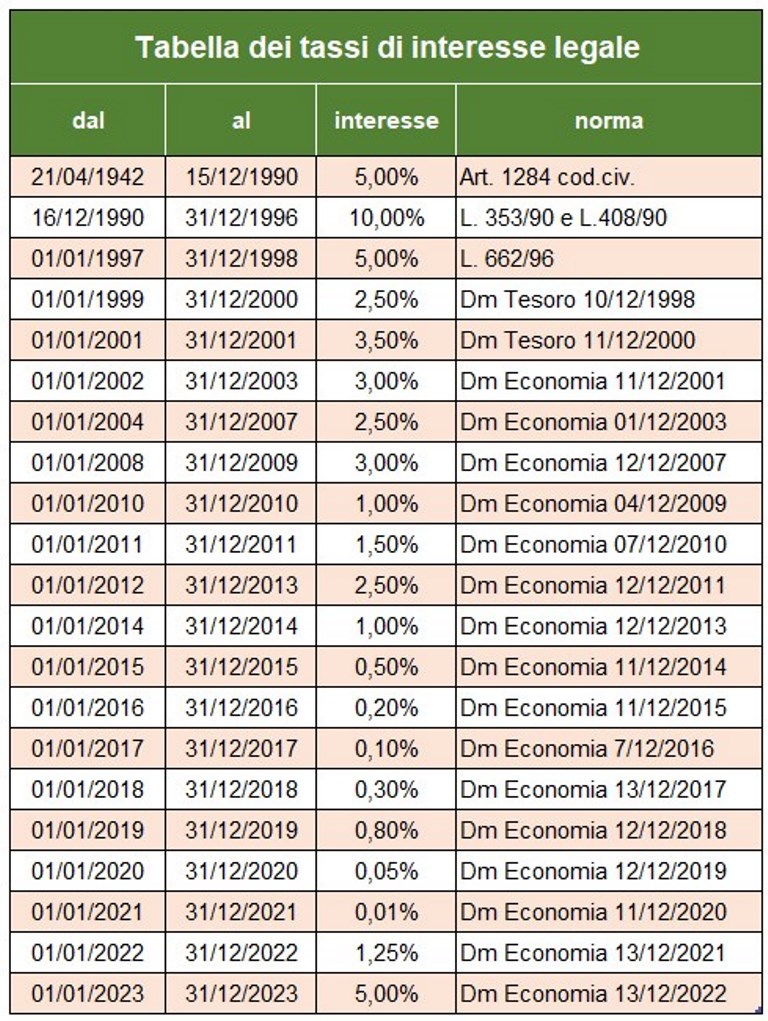

In addition to the payment of the tax due and the sanction provided for by law, it is necessary to proceed with the payment of default interest at the pro tempore legal rate in force. From 1 January 2023 this rate is set at 5%.

The payment of interest from the amendment must be made on Form F24 separately, using the appropriate tax codes.

Calculating industrious repentance

Other types of repentance (not contemplated in the program)

Penalty regime of UNDUE OFFSETTING OF NON-EXISTENT CREDITS in Form F24

The art. 27, paragraph 18 reads:

"theThe use of non-existent credits in compensation for the payment of sums due is punished with a fine ranging from one hundred to two hundred percent of the amount of the credits themselves ".

Failure to present the F24 form with zero balance

Anyone who carries out horizontal compensation must always present the F24 form, even when it has a zero balance. In fact, the model allows all the Entities to become aware of the payments and compensations made and allows the Revenue Agency to attribute the sums due to each one.

The omitted or delayed presentation of the F24 model with a zero balance can be regularised. Circular no. 54/E of 19 June 2002, the Revenue Agency clarified that to regularize this violation it is necessary:

a) submit the F24 form, within the deadline for submitting the return relating to the year in which the violation was committed;

b) pay a reduced fine, equal to:

– €. 5,56 (1/9 of the administrative fine of €. 50) if the delay does not exceed 5 days;

– €. 11,11 (1/9 of the administrative fine of €. 100) if the delay is between 6 and 90 days;

– €. 12,50 (1/8 of the administrative fine of €. 100) if the model is presented within one year of the omission.

Special Ruling 2023

Article 1, paragraphs 174 to 178 of Law no. 197 of 29 December 2022 (the so-called 'Budget Law 2023), relating to taxes administered by the Revenue Agency, introduces a new method of repentance which affects validly presented returns (therefore not those omitted!) relating to the 2021 tax period and earlier (the 2022 tax period is therefore excluded). Regularization requires the payment of a reduced penalty equal to 1/18 of the minimum, in addition to the tax and interest calculated at the legal rate. The payment can be made in a single installment by 31 March 2023, or in eight quarterly installments, increased by 2% interest.

The 'Special Ruling' is possible for violations not yet contested at the payment date.

For payments you must use:

- the F24 form, for income taxes, related substitute taxes, VAT, Irap and entertainment tax

- the F23 model, for registration tax and other indirect taxes.

- the F24 Elide for taxes, penalties and interest, connected to the registration of lease and rental contracts of real estate

Calculating industrious repentance

Let's analyze the program

With this program it is possible to calculate the voluntary correction for the main direct tax codes (IRPEF, IRAP, Municipal surtaxes, Cedolare Secca, etc.) and view a simple prospectus that can be used to compile the F24 payment model with the codes tax for penalties and interest and the summary of the calculations made.

The penalties applied by the program are listed below

For calculating interest, the program uses the updated table of legal interests (also used in other areas), and takes into account the so-called sprint correction with reduced penalties if the omitted payment is settled with a delay of no more than 15 days.

Let's see how to proceed

Data for calculations

1 – enter the unpaid tax code;

2 – date on which the tax was to be paid;

3 – date of payment from repentance;

4 – unpaid amount (omitted or insufficient);

Results

5 – days of late payment;

6 – tax codes and related amounts to be paid.

Nothing else is needed, the total amount of the correction has been calculated.

The program also offers the prospectus of the F24 model created with the calculations made.

Other free programs of the same kind offered by itieffe ▼

Calculating industrious repentance

The program below is free to use.

To access the reserved version (see below), full page and without advertising, you must be registered.

You can register now by clicking HERE